EUR/USD remains steady around 1.1200 following German inflation report.

In the early American trading hours, European Central Bank (ECB) President Christine Lagarde will testify before the European Parliament.EUR/USD remains in positive territory near 1.1200 following data from Germany indicating that the annual CPI inflation eased to 1.6% in September. Later today, investors will closely analyze remarks from Federal Reserve Chairman Jerome Powell.

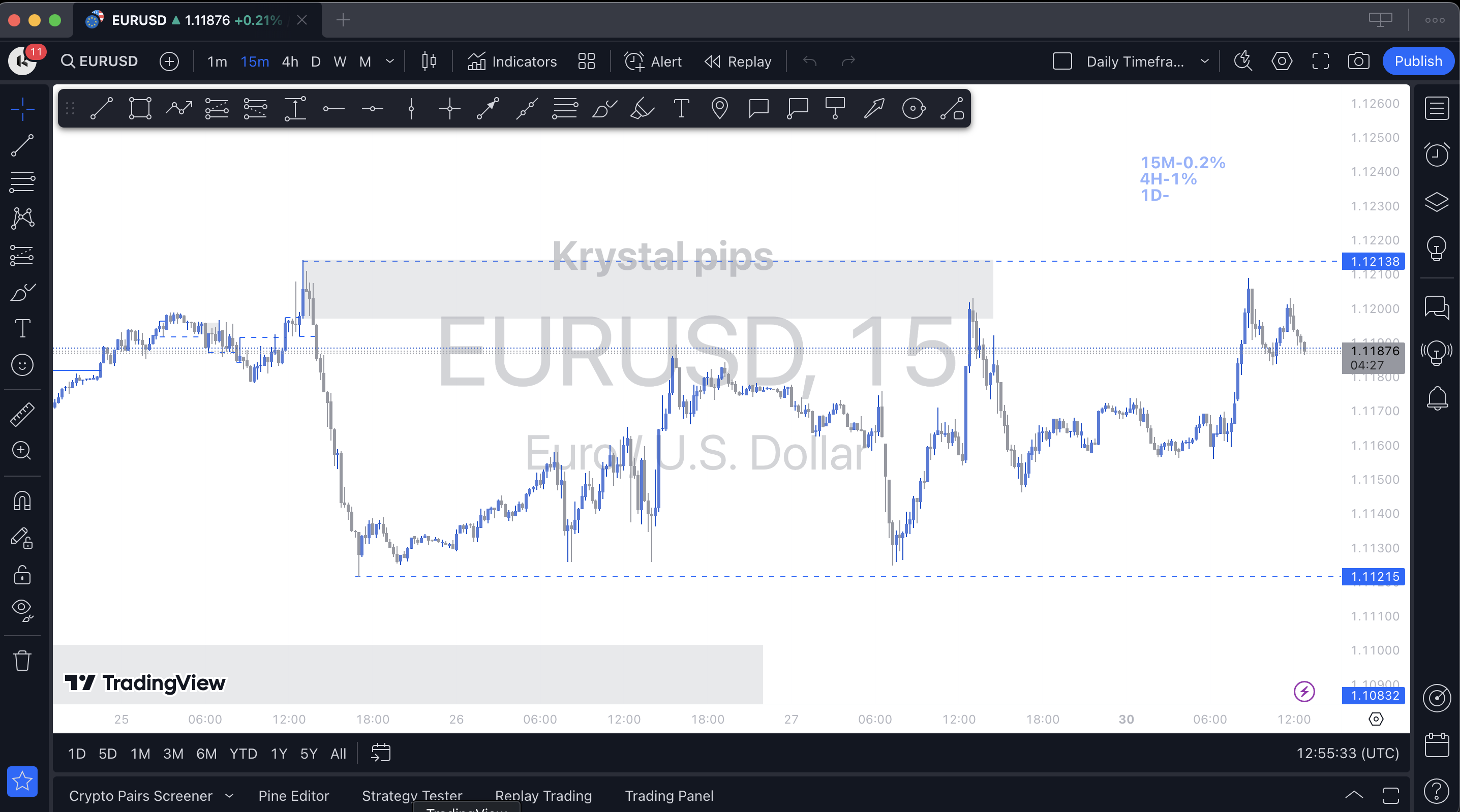

EUR/USD trades just shy of 1.1200 (static level). Should the pair climb above this level and begin treating it as support, it may continue to push higher. In this case, 1.1275 (July 18, 2023, high) could serve as the next resistance before 1.1300 (psychological level). Meanwhile, the Relative Strength Index (RSI) recently moved above 60, indicating growing bullish momentum and suggesting the pair has further upside potential before becoming technically overbought.

On the downside, 1.1160 (50-period Simple Moving Average (SMA) on the 4-hour chart, static level) acts as initial support, followed by 1.1110-1.1100 (100-period SMA, 200-period SMA).

After ending the previous week virtually unchanged, EUR/USD gains traction in the European session and rises toward 1.1200.

The Euro seems to be gathering strength following the regional inflation data from Germany. In September, the Consumer. PRICE INDEX (CPI) in Saxony rose 0.2% on a monthly basis after declining 0.2% in August, while the CPI in Bavaria increased 0.1% in the same period. Later in the session, Germany's Destatis will publish the nationwide CPI data.

In case Lagarde leaves the door open to a rate cut at the next policy meeting, the immediate market reaction could cause the Euro to come under pressure. On the other hand, the currency could preserve its strength if Lagarde refrains from committing to further policy-easing at least until the last meeting of the year.

In the second half of the day, the US economic calendar will feature the Chicago Purchasing Managers' Index and Dallas Fed Manufacturing Business Index data for September. Investors are likely to ignore these releases and stay focused on Federal Reserve (Fed) Chairman Jerome Powell's speech later in the day.

Powell will speak on the economic outlook while participating in a moderated discussion titled "A View from the Federal Reserve Board" at the National Association for Business Economics Annual Meeting, in Nashville, starting at 17:00 GMT. The CME FedWatch Tool shows that markets are pricing in a nearly 50% probability of another 50 basis points rate cut at the next meeting in November. If Powell pushes back the market positioning by voicing their willingness to continue to ease the policy in a gradual way, the US DOLLAR (USD) could find a foothold and limit EUR/USD's upside.