Daily Roundup Market Drivers:

British Pound surrenders most of its gains against US Dollar

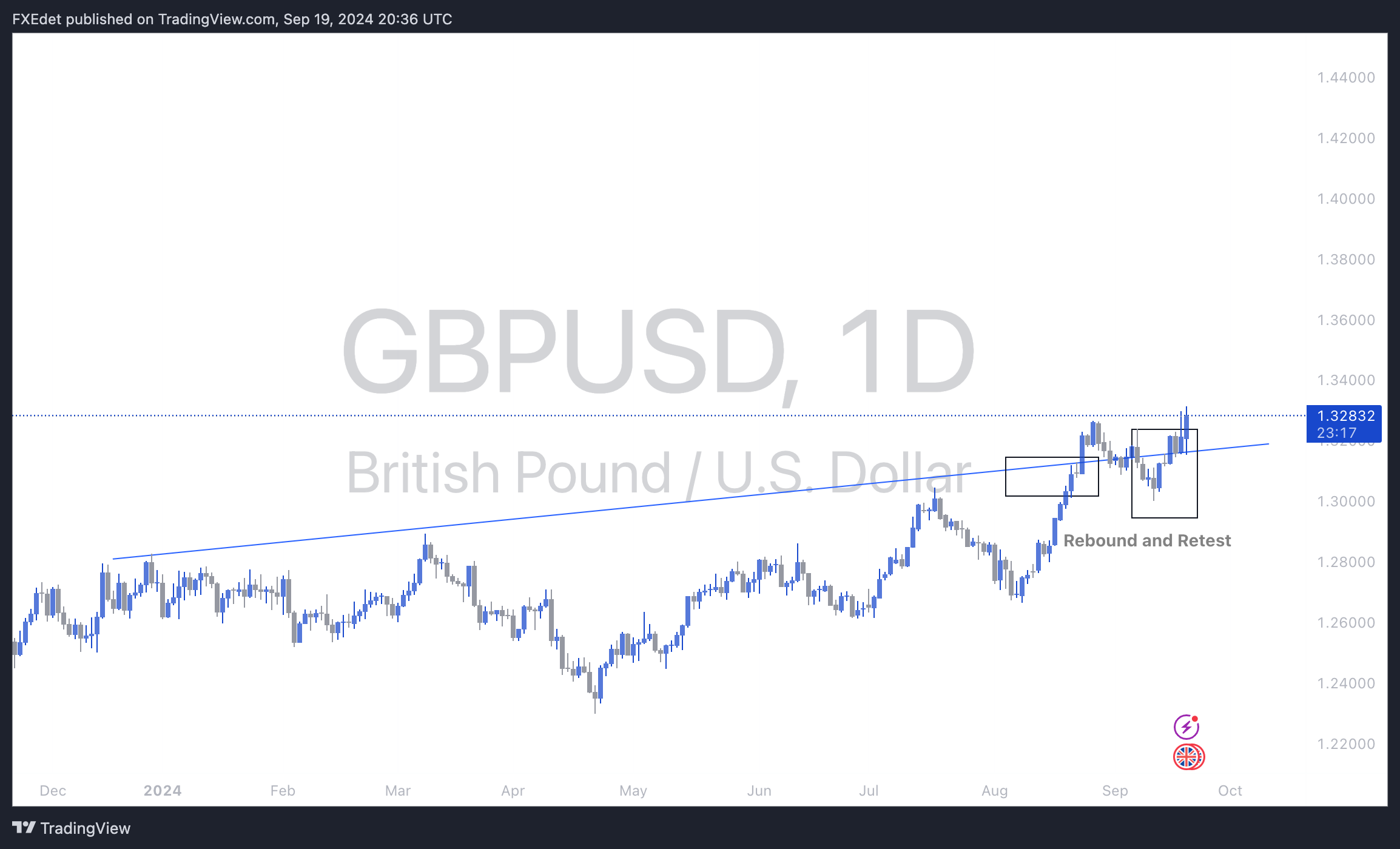

- The British Pound relinquishes the bulk of its gains against the US Dollar during Thursday's North American session. The GBP/USD pair retreats after hitting a new two-year high of 1.3300 as the US Dollar recovers following the release of the United States (US) Initial Jobless Claims report for the week ending September 13. The US Dollar Index (DXY), which measures the value of the Greenback against six major currencies, climbs back above 101.00.

- The number of people filing for jobless benefits for the first time was 219K, lower than the forecasted 230K and the prior reading of 231K, which was revised upward from 230K. The effect of the better-than-expected jobless claims data is likely to be short-lived, as market expectations for the Federal Reserve's (Fed) interest rate cut trajectory will play a key role in its next movement.

- On Wednesday, the Fed implemented a 50 basis points (bp) rate reduction, signaling the central bank's confidence that inflation is approaching its 2% target, while expressing growing concern about weakening labor market conditions. Fed Chair Jerome Powell dismissed fears of a recession in the US: "I don’t see anything in the economy right now that indicates a likelihood of a recession," he said, adding, "You see growth at a solid rate, inflation is coming down, and the labor market remains robust."

- Fed officials foresee the federal funds rate reaching 4.4% by year-end, indicating the Fed will lower rates by another 50 bps. According to the CME FedWatch tool, the likelihood of the Fed cutting rates by 25 bps to 4.50%-4.75% in November stands at 65.6%, with the remaining odds favoring a 50-bps reduction.

- Analysts at Citi expect the Fed to lower rates by 50 bps again in November. "Powell emphasized several times that today’s 50 bp cut is a 'commitment' to staying ahead of the curve, suggesting that the threshold for further large rate reductions is quite low. We continue to see risks skewed toward a sharper decline in labor market data and a quicker pace of rate cuts."